Seamless SAP-FBR Integration

TMC is Empowering Pakistan’s Businesses with Real-Time, Automated Compliance.

Gone are the days of manual, error-prone tax compliance as TMC, Pakistan’s top SAP partner, continues to revolutionize the digital landscape. And this time by seamlessly integrating SAP with the Federal Board of Revenue’s (FBR) Digital Invoicing system.

Imagine you’re running a successful business in Pakistan, but every month ends with a mountain of manual tax compliance tasks like double-checking invoices, ensuring formats match FBR’s requirements, and constantly worrying about audit risks. That’s where TMC steps in, revolutionizing how businesses handle e-invoicing through seamless SAP Integration with FBR’s Digital Invoicing system. SAP integration ensures compliance with government e-invoicing regulations and enables automated generation and registration of invoices with FBR.

Bridging the Digital Gap for FBR

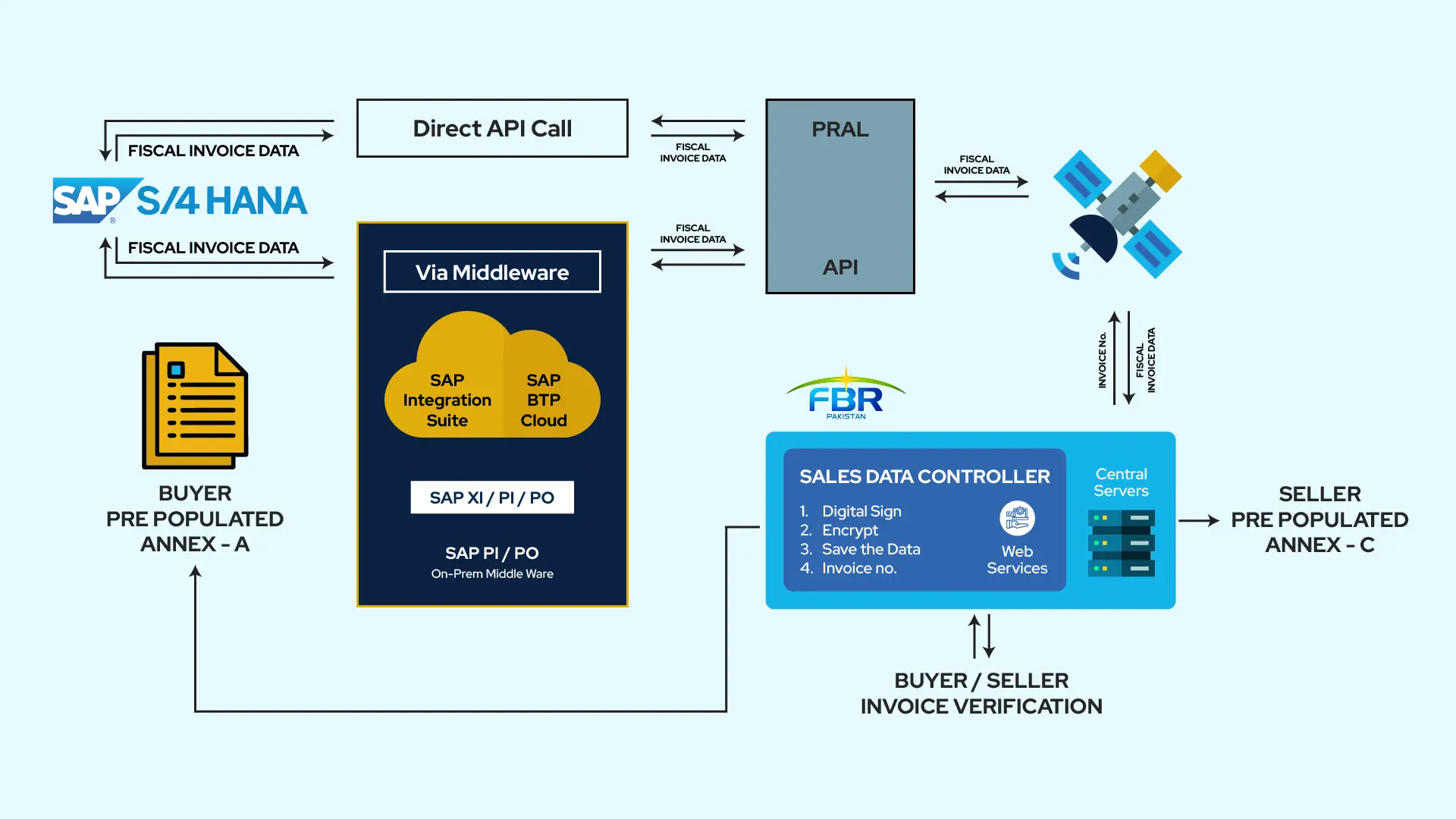

In today’s fast-paced business world, time is money. Manual tax processes not only consume resources but also expose businesses to compliance risks. Recognizing this challenge, TMC has a solution that connects your SAP system directly to FBR’s e-Invoicing platform. This SAP invoice integration benefits you with:

- Automated invoice submission in real-time

- Compliance with FBR’s regulatory requirements.

- Generation of Invoice Reference Numbers (IRNs) and QR codes instantly.

- Secure API Calls, managed through SAP PI/PO, CPI, or direct API calls.

- Real-time monitoring of transaction statuses.

- JSON Data Transformation, which ensures invoices meet FBR’s digital requirements.

The Process: From Registration to Go-Live

Step 1: Registration on FBR Portal

Your business registers on FBR’s e-invoicing portal with credentials like NTN, STRN, and CNIC.

Step 2: Test Token Issuance by PRAL

PRAL (Pakistan Revenue Automation Ltd) issues a sandbox (test) token for initial testing.

Step 3: SAP Interface Development

TMC develops a custom SAP interface (ABAP or middleware) that:

- Extracts invoice data from SAP SD/MM modules.

- Converts it to FBR-compliant JSON.

- Submits it to FBR’s API.

- Stores IRN and QR codes.

Step 4: Middleware Configuration (if required)

For complex systems, TMC configures middleware (e.g., SAP PI/PO, CPI) to handle:

- API security.

- Data transformation.

- Logging and monitoring.

Step 5: Testing

End-to-end testing with sandbox token, validating invoices, responses, and exception handling.

Step 6: Production Token Issuance

PRAL issues a production token for live invoices.

Step 7: Deployment to Production

TMC transports developments to SAP’s production environment and configures the live system.

Step 8: Go-Live & Support

The system goes live, and TMC provides post-go-live support to ensure compliance and smooth operations.

Building the Future of Compliance

At TMC, we don’t just take projects, we own them. By integrating your SAP system with FBR’s Digital Invoicing, we’re enabling your business to thrive in the digital age.

Ready to revolutionize your tax compliance? Let’s connect! Contact us today: http://tmc.local/contact